recommendations

for Moldova were prepared and presented in this article.

Keywords: digitalization;

manufacturing; Moldova, competitiveness

1.

INTRODUCTION

Moldova

is a small lower-middle income economy. It is one of the poorest countries in

Europe. Moldova has made significant progress in promoting inclusive growth and

reducing poverty and since the early 2000s. Global Competitiveness Index report

covering 141 economies measures national competitiveness—defined as the set of

institutions, policies, and factors determining the level of productivity.

Moldova was also ranked 86th (The Global Competitiveness Index 4.0 rankings

report, 2019).

The majority of the entrepreneurs recognize that digital

transformation is an excellent opportunity for development and competitiveness

(Ślusarczyk, 2018). The strengthening of digitalization processes puts

additional competitiveness pressures on manufacturing businesses. Although

digital transformation is a new concept in manufacturing (Okano, 2021), to

maintain competitiveness, steps towards the digitalization of industry have to

be implemented.

2.

LITERATURE REVIEW

2.1.

The concept of digital transformation

Digital transformation can be defined as changes in jobs and

income creation strategies, applying a flexible management model standing

against the competition, quickly meeting changing demands. It is a process of

reinventing a business to digitalize operations and formulate extended supply

chain relationships. Practical use of the internet in design, manufacturing,

marketing, selling, presenting, and data-based management model (Schallmo,

2018).

The authors highlight the importance of digitization in

the manufacturing sector and claim that companies need to implement the latest

technology (Wang, 2016).

The digital

transformation process requires companies to transform every day and be concerned

with items such as customers, business models, new technologies, agile methods,

and innovations (Okano, 2021). Considering that technologies have been

completely changing the industry and digital transformation is expected to have

a vast impact on almost any industry, digitalization can bring new

opportunities for SMEs by improving the entire value chain (Kilimis, 2019). Digitization

strengthens the potential for quality improvement, flexibility, and

productivity (Hoellthaler & Braunreuther, 2018).

Digital transformation is adopting disruptive

technologies to increase productivity, value creation, and social well-being

(Duarte, 2018).

Ulas (2019) had identified several factors expediting

digital transformation that include, among others, globalization, advancement

of technology and innovation, electronic commerce, and social media. Experts highlight four areas where

digitization technologies have the most significant impact: productivity,

revenue growth, employment, and investment (Russmann, 2015) (Table 1).

Table

1: Impact of digitization on German macroeconomics

|

Area

|

Scale

|

|

Productivity

|

More and

more companies will have to deploy digital technologies over the next ten

years, increasing the productivity of the manufacturing sector.

|

|

Income

|

The demand

for new products, new personalized products will increase revenue growth.

|

|

Employment

|

Production

growth will increase employment by around 6%. The demand for engineering in

the engineering sector will increase by 10%. Accelerating automation will replace

low-skilled workers. The growing demand for IT skills will increase the

demand for employees with competencies in the IT sector.

|

|

Investment

|

By

adapting production processes to Industry 4.0 trends, German manufacturing

companies should invest around €250 billion.

|

Source:

based on Russmann, 2015

Digitization will make a significant impact on

manufacturing companies, workforce, and companies supplying new manufacturing

systems.

2.2.

Country competitiveness definition

According to Leão de Miranda (2021), the term

competitiveness has historically been used to relate companies and nations in

terms of costs. Analyzing the concept of competitiveness, most experts agree

that competitiveness is a highly complex and multi-faceting phenomenon, as is

the competition itself, the evaluation of which requires considering the

results achieved in various areas. The concept of competitiveness begins with

trade theory (Smith, 1937).

Porter (1990) first introduced the idea of competitive

advantage. Competition based on innovation, according to Porter (1980), is the

highest stage in the development of the competitiveness of the country's

economy, characterized not only by the application and improvement of foreign

equipment and technology", but also by "the creation of new examples,

creative development of the product range, production processes, sales

organization system."

Porter (2012) identifies four stages of the competitiveness of the

national economy, corresponding to four main drivers of its development:

factors of production, investment, innovation, and wealth. At the same time,

the first three stages are characterized by an increase in the competitiveness

of the country's economy.

Krugman's (1994) position on the country's competitiveness

is based on Ricardo's classic theory (particularly the theory of comparative

superiority).

According to Krugman (1994), only companies trade and

compete. International trade allows companies to develop a division of labor

and enables the growth of the economies of all countries. Analyzing the concept

of the country's competitiveness (Rakauskienė, 2013) distinguishes three

approaches:

·

The country's competitiveness is a successful

foreign trade of the country;

· The country's

competitiveness is the productivity of the country;

· The country's

competitiveness is the ability to ensure the well-being of the country's

population.

A broad notion of competitiveness refers to the

inclination and skills to compete, win and retain a market position, increase

market share and profitability, and eventually consolidate commercially

successful activities (Filó, 2007).

The model of systemic competitiveness of Esser (2007) is

suitable for analyzing competitiveness. According to it, the country's

competitiveness consists of four levels:

a) Meta-economic level:

socio-cultural factors; value system; the country's political-economic clout;

capacity to formulate strategies and policies;

b) Macroeconomic level:

budgetary policy; monetary policy; fiscal policy; competition policy; trade

policy;

c) Meza economic level:

infrastructure policy; educational policy; industrial policy; environmental

policy; regional policy; import and export policy;

d) Microeconomic level:

management competence; company strategy.

The World Economic Forum (WEF) produces one of the

best-known competitiveness indices – the Global Competitiveness Index (GCI,

2019). The national economy competitiveness reflects the state of its

institutions, policies, and factors that determine the productivity level of

the economy, its growth level, and the prosperity level achievable for a

particular country (World Economic Forum, 2017).

Under conditions of intense business globalization,

pronounced competition, dramatic demographics (Marinović, 2017), economic

and technological changes, country economy competitiveness is gaining

importance. The WEF definition links micro- (firm-level) to macro-

(country-level) competitiveness.

The WEF's national competitiveness assessment is based on

the Global Competitiveness Index (2019), which comprises several indicators

measuring certain aspects of competitiveness, grouped into composite factors in

terms of content, which form 12 groups of competitiveness factors (Table 2).

Table 2: The content of the Global Competitiveness

Index

|

Groups of Factors

|

Factors

|

|

Institutions

|

Public

institutions (property rights; ethics and corruption; abuse of influence;

government efficiency; security); private institutions (corporate ethics,

accountability)

|

|

Infrastructure

|

Transport

infrastructure; electricity and telephony infrastructure

|

|

Macroeconomic environment

|

|

Good health and primary education

|

Health; primary

education

|

|

Higher education and

training

|

Scope of

education, quality of education, staff training

|

|

Product market

efficiency

|

Competitiveness (internal competition; foreign

competition); quality of demand conditions

|

|

Labour market

efficiency

|

Flexibility; efficient use of talents

|

|

Growth of financial markets

|

Efficiency; reliance, loyalty

|

|

Ability to harness progressing technology

|

Technology uptake; the use of ITT

|

|

Market size

|

Local market size; foreign market size

|

|

Business literacy

|

|

Innovation

|

Global Competitiveness Index

report (2019) covering 141 economies measures national competitiveness-defined

as a set of policies, institutions, and factors that determine the level of

productivity. Moldova

was also ranked 86th.

The

research objects of researchers studying competitiveness are different.

Therefore, the analyzed and described factors of competitiveness are

different. As a reason, there is no

single and universally accepted methodology for assessing the country's

competitiveness. Competitiveness is a set

of factors, institutions, and policies that determine the level of

productivity.

2.3.

Digital country competitiveness

The

Institute for Management Development (IMD, 2017), an independent academic institution

with Swiss roots and global reach, started the World Digital Competitiveness

measuring (2017).

Based

on IMD, World Digital Competitiveness (WDC, 2017) analyzes and ranks to which

extent countries adopt and explore digital technologies leading to

transformation in government practices, business models, and society.

IMD

World Digital Competitiveness Ranking measures the capacity and readiness of 63

economies to adopt and explore digital technologies as a critical driver for

economic transformation in business, government, and broader society.

Based

on institute research, the methodology of the WDC ranking defines digital

competitiveness into three main factors: knowledge, technology,

future-readiness. Moldova was not included in the digital latter ranking.

2.4.

General situation of Moldova

Business

confidence in Moldova is low, while the macroeconomic framework remains

vulnerable. Transparency, accountability, and corruption are crucial concerns

and external budget support, which is based on an agreement with the

International Monetary Fund, has a high level of conditionality. To improve

this situation, the Moldova government must carry out critical economic reforms

and create a rule-based, effective and accountable environment for businesses.

However, the recent election of Parliament shows that country is split between

pro-Russian and pro-European political powers. However, neither of these groups

didn't gain the majority, which puts the country in a situation of political

instability.

Moldova's

large-scale emigration combined with decreasing fertility rates deserves

particular attention. It has led to an alarming decline in the population and accelerated the aging

of society. Around 15% or 500 000 of the country's population live outside

Moldova. It puts pressure on the pension system and the country's long-term

competitiveness.

2.5.

Statistics of Moldova GDP

The

influence of the industry sector on Moldova's GDP is around 15%. Industry

sector in Moldova consist of mining and quarrying (B); manufacturing industry

(C); production and distribution of electricity and heat, gas, hot water and

air conditioning (D); distribution of water, sanitation, waste management,

decontamination activities (D).

The

distribution and influence of these segments on Moldova GDP can be seen in

Table 3 (Statbank, 2020).

According

to the statistics department of Moldova, the industry sector was on the rise during

the period of 2014-2015 and started to decrease from 2016 to 2019 (Statbank,

2020).

Out

of four segments, manufacturing is by far the most significant sector, and it

saw the most significant increase over the period of 2014-2019.

Sectors

D and E showed an upward trend. However, it wasn't substantial compared to

manufacturing. Last but not least, the Mining and quarrying sector remains the

same.

Table 3: Contribution

of economic activities in the GDP formation, %

|

Year

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|

(B)

Mining and quarrying

|

0.3%

|

0.3%

|

0.2%

|

0.2%

|

0.2%

|

0.3%

|

|

(C)

Manufacturing

|

11.6%

|

12%

|

11.9%

|

11.6%

|

11.2%

|

10.6%

|

|

(D)

Production and distribution of electricity and heat, gas, hot water and air

conditioning

|

2.5%

|

2.5%

|

2.5%

|

2.4%

|

2.5%

|

2.3%

|

|

(E)

Distribution of water, sanitation, waste management, decontamination

activities

|

0.8%

|

0.8%

|

0.8%

|

0.8%

|

0.8%

|

0.8%

|

The

volume of industrial production indicates annual growth in this sector (Table

4). Since 2010, industrial production has increased by 40,7%. This pattern is

evident in the manufacturing segment, which, compared to 2010, rose by 52.2%.

The mining and quarrying sector reached its highest point in 2011. Since then,

there is no general pattern that could define this sector's growth dynamics.

The

amount of production during 2018 reached the volume of 2010. Last but not

least, production output in electricity and heat, gas, hot water, and air

conditioning segment increased by 7,5%. There is no statistical information

about water, sanitation, waste management, decontamination segment (Statbank,

2021).

Table 4: Volume indices of industrial

production, 2010=100%

|

Year

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

|

Industry

- total

|

113.4

|

110.7

|

120.2

|

129.0

|

129.9

|

131.1

|

135.6

|

140.7

|

143.7

|

135.5

|

|

(B)

Mining and quarrying

|

127.2

|

100.3

|

122.6

|

122.9

|

111.6

|

94.3

|

90.2

|

100.3

|

97.4

|

107.3

|

|

(C)

Manufacturing

|

113.9

|

113.2

|

125.2

|

135.9

|

139.0

|

141.5

|

148.1

|

152.2

|

157.1

|

145.8

|

|

(D)

Production and distribution of electricity and heat, gas, hot water and air

conditioning

|

98.1

|

99.0

|

94.8

|

99.0

|

100.1

|

99.2

|

97.9

|

105.6

|

100.4

|

102.1

|

The

main factors which led to the growth of the industrial sector are: the

expansion of the foreign investor's activities, especially in the automotive

industry, the positive developments in the agricultural sector that stimulated

the growth of the food industry, the increase of domestic and foreign demand

for national industrial products, due to the opening of the foreign and the

implementation of the international economic cooperation agreements.

Industry

sector production output is rising; however, this sector's amount of labour

force is relatively stable (Table 5). Compared to the entire country, the share

of employees in the industry is relatively stable – around 12%. Even though the

number of employees was regular, monthly average earnings rose during the last

five years (Statbank, 2021).

Compared

to the entire Moldova economy, wages in the industry sector are more

significant. However, this industry sector average is distorted by Electricity,

gas, steam, and air conditioning supply segment (D).

In

general, production output is rising, but the fact that industry is dominated

by resources-intensive and low-medium tech companies combined with increasing

labour costs means that the Moldova industry sector's competitiveness could have competitiveness-related

issues.

Table 5: Employed

population

|

Year

|

2010

|

2011

|

2012

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

2019

|

|

Industry % of total

|

18,64

|

18,75

|

19,28

|

17,69

|

17,90

|

17,85

|

17,14

|

16,65

|

19,40

|

21,71

|

Despite its growth and importance to the

country's economic performance, the manufacturing sector has to improve.

The

structure of the manufacturing segment is dominated by resource-based

businesses, which account for almost half of manufacturing companies (45.2%).

Low-tech and medium-tech manufacturing companies account respectively 26.1% and

25.2%.

The

share of high-tech companies is extremely low and makes up only 3.5% of all

manufacturing businesses (Competitive Industrial Performance Index, 2020).

Finally,

the manufacturing sector composition is mainly dominated by food and beverages

production. This segment accounts for 40.4% of all manufacturing production.

The other four most significant segments are wearing apparel, fur (10.9%);

non-metallic mineral products (9.4%).

2.5.1. Business structure

Data

of 2016 shows a total of 51,600 SMEs in Moldova or 98.7% of total registered

enterprises (Table 6). 20,300 or almost 40% of the total number of SMEs are

active in the wholesale and retail trade. The second largest category

represented by SMEs is the "other" with manufacturing and

professional services, scientific and technical activities representing the

third largest category with an equal amount of 4,400 SMEs each (or 8.5% of the

total number of SMEs).

SMEs

sector in 2016 employed 313,500 employees or 61.2% of the entire workforce.

However, it should be noted that micro-enterprise is the most significant

segment in SMEs structure and makes up 85.1% of it. Despite that, a number of

employees in the SMEs segment are distributed relatively equally. Small and

medium-size enterprises contribute a total of 31.4% of GDP in Moldova.

In

terms of income, SMEs have generated a total of nearly €2.5 billion in 2016.

The main contributing sectors are wholesale and retail trade with approximately

49% and manufacturing industry with approximately 11%.

Table 6: Indicators related to the SME activity

in 2016

|

Indicator

|

Number

of units, thousand

|

Percentage

of total in RM %

|

Number

of people, thousand

|

Percentage

of total in RM %

|

|

Total

SMEs of which:

|

51.6

|

98.7

|

331.5

|

61.2

|

|

Medium-sized

enterprises

|

1.3

|

2.5

|

101.5

|

19.8

|

|

Small

enterprises

|

5.8

|

11.0

|

107.2

|

20.9

|

|

Micro

enterprises

|

44.5

|

85.1

|

104.8

|

20.5

|

2.5.2.

Local ecosystem

Moldovan

government structure in relation to industry digitisation together with

research and development is quite broad. The development of the R&D system

of Moldova underwent different phases and was administered by a number of

government departments and institutions, however, since 2004, this role is

dedicated to the Moldovan Academy of Sciences (ASM). The Academy is the main

policy-making institution and fulfills, to a large extent, the role of a

Ministry of Science.

The

president of ASM is a member of the Government. It is an elected eminent

national scientist who enjoys full independence from political views. ASM works

as the research policy-making body, it manages most of the public R&D

funds, and is the main research performing institution in the country. However,

various experts emphasize that this situation results in a clear institutional

conflict of interest since it places ASM as a policy-maker and funding agency

while being at the same time the major beneficiary of the research funds.

Besides

Moldovan Academy of Science, there are also Moldovan ministries, which are

directly involved in the management of research and innovation policy/or

funding. The Ministry of Finance defines the allocation of government resources

for R&I activities. The Ministry of Economy is also involved and deals with

innovation and technology transfers in the business sector.

Ministry

of Environment is responsible for allocation of moderate R&D funding

through its National Environment Fund (FEN). Besides that, Ministry of Health

also disposes several subordinated health research institutions. Last but not

least, Ministry of Education oversees Moldova higher education sector in order

to strengthen the research capacities at universities.

Besides

governmental level, Parliament of Moldova is also involved in R&D affairs.

Within Parliament, the Committees on Culture, Education, Research, Youth, Sport

and Mass-media are responsible for the analysis and improvement of draft acts

related to science and innovation.

Moldovan

Academy of Science and its subordinated bodies are the main stakeholders for

policy implementation. There is a Centre for Fundamental and Applied Research

Funding (CFCFA) within ASM, established in 2012 for the allocation of public

funding for fundamental and applied research and which manages the main

Moldovan funding programs.

Other

institutions are Moldovan Agency for Innovation and Technology Transfer (AITT),

which is funding institution and responsible for supporting innovation and

technology transfer. In addition, the Ministry of Economy also established

Organization for SME sector development (ODIMM), which is responsible to

provide support for SMEs in Moldova.

One

more important agency operating in innovation system is the National Council

for Accreditation and Attestation (CNAA). This organization is highly relevant

for institutions wanting to become eligible for public R&I funding. These

have to undergo an evaluation and accreditation procedure, conducted by the

CNAA.

Accreditation

is granted for a period of up to five years. Under the Code on Science and

Innovation all research organizations accredited by the CNAA become members of

the Academy of Science. There should be noticed a significant difference

between capital Chisinau and the rest of the country in regards to CNAA

activity. During the period of 2005-2013, CNAA accredited 60 organizations, but

only three were situated outside Chisinau.

Last

but not least, it also worth mentioning innovation agencies operating outside

the ASM structure. These are the State Agency on Intellectual Property of the

Republic of Moldova (AGEPI) and the National Environmental Fund (FEN). First

institution takes care of protection of intellectual property and the latter

one manages dedicated research funding under the Ministry of Environment.

Majority

of the entrepreneurs recognize the industry digitalization as a great

opportunity for development and improvement in competitiveness

(Ślusarczyk, 2018). The strengthening of digitalization processes may put

additional competitiveness pressures on manufacturing businesses. In order to

maintain the competitiveness, the industry should step towards the

digitalization.

Digitization

offers the potential for quality improvement, flexibility and productivity

(Hoellthaler & Braunreuther, 2018).

In

order to generate specific steps/recommendations in regard to the digitisation

of Moldova industry, the further analysis have been made.

3.

DATA AND METHODOLOGY

SWOT

Analysis is a decision-making method, and it has been widely used in the

management process. SWOT analysis has successfully been applied in identifying

and solving problems (Mainali, 2011).

SWOT

analysis was applied to evaluate the current situation and future possibilities

for the Moldova industry sector. This method is selected because it can

incorporate the present conditions (through strengths and weaknesses) and the

future conditions (through opportunities and threats).

The

research adopts an expert interview approach to gather information. The main

input for the SWOT analysis was knowledge and information collected through

interviews with relevant experts.

Experts

interviews is a popular method of gathering information in various fields of

political and social science. It can provide insight and valuable knowledge in

the relevant field. It is also considered an efficient and concentrated method

of gathering data, especially in the exploratory phase (Bogner et al., 2009).

Selecting

the relevant experts is essential to gather usable information. The experts

interviewed for this research compose of people who work closely in

digitalization or competitiveness.

Also,

the triple helix approach was used to involve experts from Government,

industry, and academia.

The

list of their qualifications is provided in Table 7.

The

interview was conducted through one-to-one interviews. The responses were

collected from the respondents using a mixture of open-ended and scaled

questions. To provide a quantitative assessment, the respondents were asked to

rank their preferred option using the scale of 1 to 5 (1 - most unsuitable, 5 -

most suitable).

Table 7: Qualifications of experts

|

Respondents

|

Qualifications

|

Field of expertise

|

|

1

|

Digitalisation expert at the governmental public agency with more than 20

years of experience in digitalisation area. Male, 52 years old

|

Government

|

|

2

|

Professor of management of Vilnius Tech University. Male, 35 years old

|

Academic researcher

|

|

3

|

Professor of Economics of Mykolas Romeris University. Femaile, 66 years

old

|

Academic Researcher

|

|

4

|

Coordinator of Digital innovation hub in Lithuania. Female, 41 years old

|

Industry

|

|

5

|

CEO of Science and technology park in Lithuania. Male, 53 years old

|

Academic Researcher

|

|

6

|

CEO of regional business association. Male, 44 years old

|

Industry

|

|

7

|

Innovation manager, digitalisation consultant, with more than 20 years of

experience in digitalisation area. Male, 51 years old.

|

Consultant

|

Source: compiled by the

authors

4.

RESULTS AND DISCUSSIONS

In

terms of its positive qualities (strengths and opportunities), the respondents

emphasise on different aspects of Moldova industry sector

In

order to understand the current situation and future possibilities for Moldova

industry sector, SWOT analysis has to be performed (Table 8).

Table 8: SWOT analysis

|

Strengths

·

Industry sector and

manufacturing segment output is rising;

·

Well-developed,

consistently updated public and private ICT infrastructure;

·

Moldova ranks 6th

worldwide translating its innovation inputs into outputs

·

Digitization

solutions providers can supply a wide range of digitization services (by

increasingly participating in local and global value chains, related to ICT,

robotics, automation, electronics, cyber security, digitization solutions

providers can offer services ranging from standard adaptable services to

specialized services);

·

Moldova ranked 5th in

regards to business friendly environment, according to fDi Manufacturing

Locations of the Future 2018/19 ranking TOP 10 Manufacturing Countries of the

Future 2018/19.

|

Weaknesses:

·

Moldova innovation system consists of many institutions

which whose competences overlap;

·

SMEs still lack appropriate education and entrepreneurial

skills, understanding of HR remains low, digitalization and modernization of

operations are still lagging;

·

Contribution of industry sector to Moldova's GDP is quite

low (~15%);

·

Moldova export is mostly dominated by agricultural goods;

·

The manufacturing sector comprises only ~12% of country's

GDP, which is low. Around 20% is considered to be optimal;

·

Issues in education and research system. Due to difficult

social and economic situation since the country's independence, cuts were

made for education and research which led to very low investments in these

sectors over years;

·

Moldova R&I system presents several structural

weaknesses such as low financing, ageing, migration and downsizing of the

R&D personnel;

·

Country has 31 universities and 45 colleges, however only

4 universities and 6 colleges tech ICT. In 2016 just 823 students graduated

with ICT related qualifications (out of 24,000 graduates);

·

Moldova competitiveness rating is low (According to World

Economic Forum Global Competitiveness Index 4.0 2018 edition, Moldova is 88

out of 140 countries);

·

Moldova ranks poorly on the Corruption Perception Index.

According to Transparency International's Corruption Perception Index 2014,

Moldova ranks 103 on the list of a total 175 countries;

·

Differences between capital Chisinau and the rest of the

country in regards to innovative activities;

·

Moldova manufacturing sector competition is interrupted.

Moldovan manufacturing sector have an oligopolistic or monopolistic market

structure.

·

Industry is dominated by micro and small companies that

do not have an adequate demand or extent for the installation of digitization

technologies (since digitization is more relevant for medium-sized and large

companies);

·

Industry's technological readiness level is low (low- and

medium-tech technological businesses dominate; industry is oriented towards

the employment of used, second-hand manufacturing equipment and cheap labor;

too little comprehension about what equipment is needed, how to optimally

integrate and utilize it; few companies apply real-time analytics

·

There is a lack of systemic integration (the digital

technological equipment companies have is acquired through separate

initiatives and projects; there is a lack of systemic integration that would

ensure a transparent transfer of data as well as horizontal and vertical

integration within companies and in the exchange of data with other creators

of the shared value chain; due to their price, such solutions, although

available on the market, are often hardly financially obtainable for the

local SMEs);

·

The majority of manufacturing companies produce/provide

low added-value products/services

·

Issues with standardization and interoperability of

systems (it is difficult to make different systems compatible and to

integrate them together);

·

Too limited supply of qualified and specialized

innovation support services. There are a lot of "generalists"

amongst intermediation, facilitation and motivation service providers, but

when companies need to solve concrete problems that require deeper,

specialized knowledge, it becomes difficult to find such experts

|

|

Opportunities

· The share of industry sector to Moldova GDP is on the

rise;

·

Various strategic

documents include industry sector as one of the priorities which has to be

developed. However, industry digitization isn't mentioned as a separate

priority

·

Bringing back and

attracting talents from abroad;

·

Vocational training

and retraining of employees;

·

A promising

innovative sector for the country is Information and Communication

Technologies (ICT), which has gained weight similar to that of other CIS

countries;

·

Integration with EU:

Moldova is a member of Eastern Partnership with EU and has an Association Agreement with

European Union signed in 2014. Integration with EU will provide various

advantages and support measures. Country participate in Horizon 2020 and

Smart Specialization Strategy;

· International financial institutions readiness to support

transformation processes;

·

Opportunities for

business to get to know and use more financial support and measures;

·

In 2017 Moldova

launched a number of reforms such as labor code or labor migration, however,

the implementation and the effects of reforms are still unclear;

·

Clusters policy is

present in some policy documents. Moldova is on the right track, understanding the importance of

clustering, however there is a long way to go in regards to the development

of it.

|

Threats

·

The industry

digitization market is, and remains, limited (due to industry domination by

small companies or the state of the economy);

·

Manufacturing

companies are not able to adapt and switch to global business models;

·

Imported digitization

technologies do not have an adequate support (in either projecting,

installation or service) in manufacturing companies due to the lack of

variety of such services and their quality;

·

Shortage of talents

due to migration and flight of human capital ("brain drain")

(internal migration from regions to cities; emigration from Moldova to

foreign countries);

·

Deficit of

professionals due to the current demographic situation;

·

The higher education

institutions are not capable of preparing suitable specialists (due to the

inappropriate digital technologies infrastructure aimed at study; due to

insufficient lecturers’/vocational teachers' qualifications in industry

digitization matters);

·

Inflexible regulation

of work conditions regarding organization and installation of digital

workplaces in companies;

·

A fragmented and

underdeveloped innovation support and innovation consulting services system

that otherwise would make the creation and installation of digital

innovations in industry more effective

|

Source: compiled

by the authors

Based on it, recommendations and measures will be drawn.

4.1.

A

Vision of digitalized Moldova industry

Following

the SWOT, the vision concerning the future of digitalized Moldova manufacturing

sector can be established.

Internal/Company-related factors:

- Moldova is dominated by relatively small, smart and agile factories

manufacturing higher value-added products for niche markets; flexible

organizations can diversify rapidly to meet changing market needs.

- Moldovan capital and foreign capital companies operating in Moldova

are deeply embedded in international value chains through ownership,

production partners and realization markets.

- Moldova is a 'testbed' for new cutting-edge technological solutions

created across Europe, Japan and USA – first deployed in Moldova industry

for demonstration purposes; then, spread across all of Europe. Therefore,

Moldovan solution providers and solution integrators always work with the

latest technologies.

External/Environmental factors:

- Moldova provides access to a variety of specialists that the

industry demands, as required, for digitisation.

- Moldova provides opportunities for lifelong learning, non-formal

education and competence enhancement, through

industry-university/college-cooperation.

- Moldova is a destination of choice for talented professionals from

abroad and international students (who stay and work in Moldova after

their studies).

- Moldova remains in the top European states that continually sustain

a state-of-the-art infrastructure for industry development (accessible

transportation, logistics, and energy in every corner of the country, as

well as ICT appropriate to the 5G network and Industry 4.0).

4.1.1.

Strategic Pillars Supporting the

Vision

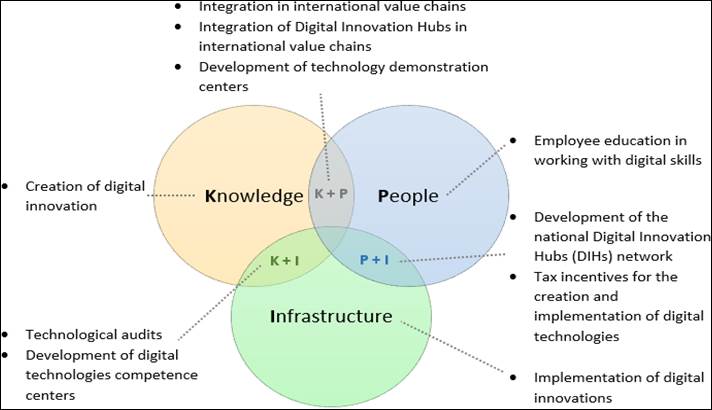

Moldova

industry digitisation action plan should be supported

by 4 pillars: Knowledge, People, Infrastructure and Environment.

Each of these foundations encompasses distinct target priorities identified by

experts and addressed by specific policy measures.

Knowledge considers technologies and business models that will become integrated

through value chains.

People refers to policy-makers, researchers and creators, enablers, and

intermediaries that will play a critical role in the digitisation of industry

along the private sector and investors.

Infrastructure regards services infrastructure, demonstration infrastructure, and

R&D infrastructure which, when combined, will provide the best possible

conditions for manufacturing innovation.

Environment concerns the legal and regulatory environment, standards, and

incentives system that will embed industry in a smoothly performing facilitation

network within the local ecosystem.

Strategic

pillars cover areas

that are in most need of action in order to achieve the digitalised industry's

vision (Figure 1).

To

overcome these challenges, digital competences and skills must be developed to

assist companies in creation, adoption and implementation of digital solutions.

By using opportunities provided by digitisation, companies would become enabled

to increase their productivity, production value and to internationalise.

There

are the key measures to accomplish that (Table 9):

Figure 1: Strategic pillars

Actions

are designed to reflect 4 strategic ares, where the action is most needed: Knowledge, People, Infrasctruture

and Environment.

|

K1 –

Technologies

K2 – Business

Models

|

P1 – Policy-makers

P2 – Researchers and

Creators

P3 – Enablers

P4 –

Intermediaries

|

I1 – Services

Infrastructure

I2 –

Demonstration Infrastructure

I3 – R&D

Infrastructure

|

E1 – Legal &

Regulatory Environment

E2 – Standards

E3 – Incentives

|

Table 9: List of measures

|

No

|

Measures

|

Pillars and priorities (K, P, I, E)

|

|

1.

|

Creation of digitisation technologies

|

K1

|

|

1.1.

|

Preparation of the policy mix for implementation of the new S3

|

K1; E1

|

|

1.2.

|

Implementation of the new S3

|

K1; E1

|

|

2.

|

Adoption (import) of digitisation technologies

|

K1

|

|

2.1.

|

Identification and wider implementation of national and international

good practice

|

K1

|

|

2.2.

|

Identification of pilot projects to transfer and to test those

technologies defined as most influential in the digitisation of local

industry that could later lead to whole industrial development

|

K1

|

|

2.3.

|

Preparation of measures for larger-scale implementation of successful

pilots

|

K1

|

|

3.

|

Joining international technology development value chains (for

instance, international clusters, international R&D programmes)

|

K1

|

|

3.1.

|

A continuous call for an international partner search measure

|

K1; E3

|

|

3.2.

|

Preparation of co-financing schemes describing how Moldova will

support entities accepted into international consortiums and are awarded

grants that require co-financing

|

K1; E3

|

|

3.3.

|

Preparation of financing schemes for the funding of cross-sectoral

initiatives for participation (incl. operational costs) in international

networks, clusters, platforms, working/topic groups, etc.

|

K1; E3

|

|

4.

|

Development of industrial graduate programmes in

areas related to industry digitisation

|

K1; P2

|

|

5.

|

Development of safe and (cyber) secure technologies by design

|

K1

|

|

6.

|

Creation of business models oriented towards integration in

international value chains

|

K2

|

|

6.1.

|

Identification of pilot projects to transfer digital

technologies (implementation) management know-how from foreign countries that

are most relevant for the local industry and could later lead to whole

industrial development

|

K2; K1

|

|

6.2.

|

Preparation of measures for the larger-scale implementation of successful

pilots of digital technologies (implementation) management tools

|

K2; K1

|

|

7.

|

Continued support of measures for participation in international

knowledge dissemination networks (e.g. exhibitions, trade missions, and

through agents)

|

K2; E3

|

|

8.

|

Development and implementation of public servants' qualification

improvement and training programmes that cover industry digitisation

challenges

|

P1

|

|

9.

|

Support measure for the transfer of good practice from foreign

countries (e.g. pilot projects for transfer and adaptation of other

countries' good practice; triple-helix stakeholders' visits to good practice

countries to understand the implementation of policy measures)

|

P1; E3

|

|

10.

|

Revision, updating and preparation of study programmes, related to

industry digitisation

|

P2

|

|

11.

|

Renewal of teaching resources, laboratory equipment and learning tools

|

P2; I2

|

|

12.

|

Development of bachelor and master level digital manufacturing study

programmes and related bridging courses for college graduates

|

P2

|

|

13.

|

Development and implementation of interdisciplinary study programmes

(e.g. Smart Production Technologies & Robotics, IT & Robotics, Laser

cutting & Metalworking)

|

P2

|

|

14.

|

Development and implementation of vocational teachers' and lecturers'

qualification improvement and training programmes that cover industry

digitisation challenges

|

P2

|

|

15.

|

Creation of support measure for the use of infrastructure of business

clusters and open access centres by researchers (e.g. for qualification

improvement and training purposes)

|

P2; E3

|

|

16.

|

Private/public initiatives to attract talented professionals from

abroad

|

P2; E3

|

|

17.

|

Implementation of employee qualification improvement and training in

workplace programmes targeting the application of digital technologies (e.g.

by expanding the apprenticeship/vocational training model to encompass

workers as well as production technologists)

|

P3

|

|

18.

|

Recruitment of foreign students who potentially could work in local

industry companies after graduation

|

P3

|

|

19.

|

Integration of management and technology transfer study modules in

technological studies (e.g. engineering in digital manufacturing and related

studies)

|

P4

|

|

20.

|

Informal education programmes for the training of intermediaries and

possibilities for recognition

|

P4

|

|

21.

|

Systemic and regularly performed research in

forecasting and prediction of international value chains trends

|

I1

|

|

22.

|

Systemic and regularly performed research to identify industry needs

for support services (e.g. surveying companies, sectoral analysis)

|

I1

|

|

22.1.

|

Surveys on funding measures (evaluation of the measures, by surveying

participating companies immediately after a call for proposals ends)

|

I1

|

|

22.2.

|

Surveys on technologies for the identification of technologies of

current relevance to companies

|

I1

|

|

22.3.

|

Surveys for a sectoral analysis/review of value chains (monitoring and

analysis of existing and future value chains)

|

I1

|

|

23.

|

Creation of Digital Innovation Hubs (DIHs) service network

|

I1

|

|

23.1.

|

Pilot measure for the development of DIHs' service infrastructure

|

I1

|

|

23.2.

|

Mapping of potential DIHs (to identify which organizations can be

incorporated or join DIHs)

|

I1

|

|

23.3.

|

Prepare co-financing schemes showing how Moldova will support DIHs

accepted into international networks

|

I1; E3

|

|

23.4.

|

Permanent measure

|

I1

|

|

23.5.

|

Creation of conditions to connect to public infrastructure and

utilities governed by the state or municipalities (electricity, gas, water,

data necessary for Industry 4.0)

|

I1; E2

|

|

24.

|

Development of 5G network

|

I1

|

|

24.1.

|

Organization of auctions for 5G frequencies (3400-3800 MHz, 700 MHz)

|

I1; E2

|

|

24.2.

|

Allocation of 5G frequencies (3400-3800 MHz, 700 MHz) for commercial

uses

|

I1; E2

|

|

24.3.

|

Review and approval of changes to the hygienic norms of

electromagnetic radiation: increase the radiation threshold to equalize it to

the standard acceptable to the rest of Europe and application of changes to

the measurement methodology

|

I1; E2

|

|

24.4.

|

Easing of regulations (e.g. elimination of, or reduction in

conditions, to receive permissions, especially in the case of pico- and

microcell instalment)

|

I1; E2

|

|

24.5.

|

Establishment of opportunities for network operators to use public

infrastructure (e.g. lighting towers, buildings, chimneys, other objects) for

instalment of mobile network elements/equipment with conditions appropriate

to support 5G

|

I1; E2

|

|

24.6.

|

Development of infrastructure necessary for 5G alongside or during

implementation of governmental/municipal projects regarding transport and

energy

|

I1

|

|

24.7.

|

A developed 5G network

|

I1

|

|

25.

|

Development of digital technology demonstration infrastructure

|

I2

|

|

26.

|

Development of digital technology demonstration infrastructure

|

I2

|

|

26.1.

|

Development of the national digital technology demonstration concept

|

I2; E1

|

|

26.2.

|

Virtual factory (e.g. an interactive platform or a webpage with remote

control and simulations of technologies)

|

I2

|

|

26.3.

|

A measure for the development of 'digital twins' in factories

|

I2; E3

|

|

26.4.

|

Demonstration of exemplary digital technologies and digitisation

solutions based on national and international good practice

|

I2; K1

|

|

26.5.

|

Transfer of good practice from abroad (e.g. a technology demonstration

centre, where various technological solutions offered by a number of

companies, and their integration possibilities, are demonstrated on one site)

|

I2; K1

|

|

26.6.

|

Creation of 2 exemplary physical digital

technology demonstration centres alongside developers of digital technologies

|

I2

|

|

27.

|

Investment in Digital Innovation Hubs' (DIHs') infrastructure

necessary for the development of digital technologies

|

I3

|

|

27.1.

|

Pilot measure for the development of DIHs' innovation and R&D

infrastructure for digitisation services

|

I3

|

|

27.2.

|

Support for 4-5 infrastructure development projects for DIHs

|

I3

|

|

28.

|

Introduction of guidelines for IT/R&D public procurement

procedures

|

I3; E1

|

|

29.

|

A continued development of clusters' shared access centres for

innovation and R&D

|

I3

|

|

30.

|

Development of technology prototyping, testing and pilot production

infrastructure

|

I3

|

|

30.1.

|

Support for 4-5 infrastructure development projects for prototyping,

testing and pilot production

|

I3

|

|

30.2.

|

Support for the development of 4-5 competence centres running on an

open access model in the topic areas related to DIHs' activities

|

I3

|

|

31.

|

Creation of industry transformation strategy

|

E1

|

|

32.

|

Innovation system reform concerning industry digitisation

|

E1

|

|

33.

|

Refinement of work relations regulations

|

E1

|

|

34.

|

Issuance of regulation regarding service provision by Open Access

Centres (OACs)

|

E1

|

|

35.

|

Preparation of Digital Innovation Hubs (DIHs) development concept

|

E1

|

|

36.

|

Establishment and/or enforcement of regulation in intellectual

property dispute resolution - e.g. between researchers and universities,

between customers (businesses) and executors (universities)

|

E1

|

|

37.

|

Introduction of regulation for technology demonstration equipment use

and accounting (i.e. amortization, deductible expenses issues)

|

E1

|

|

38.

|

Elimination of obstacles to universities and research institutes

managing held infrastructure (land, buildings, equipment)

|

E1

|

|

39.

|

Development and implementation of standards to support industry

digitisation

|

E2

|

|

39.1.

|

Recognition of researchers' contribution to standardization work (similar

to traditional scientific publications)

|

E2

|

|

39.2.

|

Legislation to promote the application of standardisation as an

instrument for innovation development and economic growth

|

E2

|

|

39.3.

|

Promotion of the value of standards to support innovation

|

E2

|

|

39.4.

|

Implementation of standards associated with industry digitisation

|

E2

|

|

39.5.

|

Enforcement of compliance with the standards

|

E2

|

|

39.6.

|

Facilitation of conditions for connections to public infrastructure (incl.

adaptation of services to industry needs)

|

E2

|

|

40.

|

Promotion of interoperability

|

E2

|

|

41.

|

Building blocks for national and cross-border G2B services

|

E2

|

|

41.1.

|

Preparation of usability guidelines for Industry 4.0

|

E2; E1

|

|

41.2.

|

Enforcement of compliance with the usability guidelines

|

E2; E1

|

|

42.

|

Development of tax reliefs for promotion of industry digitisation

|

E3

|

|

42.1.

|

Creation of tax reliefs for accelerated capital allowance and hyper

and/or super-depreciation of tangible and intangible assets related to

digital technologies

|

E3

|

|

42.2.

|

Extension of a current tax relief regarding asset depreciation after

the year 2023

|

E3

|

|

42.3.

|

Implementation

|

E3

|

|

43.

|

Support for R&D in creation of digital technologies and digitisation support for prototyping and pilot production

|

E3

|

|

43.1.

|

Preparation of support schemes for R&D, prototyping and pilot

production in relation to S3

|

E3

|

|

44.

|

Support for implementation

of digital technologies

|

E3

|

|

44.1.

|

Preparation of support

schemes for implementation of digital technologies

|

E3

|

|

44.2.

|

Support projects

|

E3

|

|

44.3.

|

A separate measure for research groups' projects for

business (whereby the best scientists from all Moldova universities work

together to solve business problems)

|

E3

|

|

45.

|

Support for companies in the purchasing of services

related to digitisation (e.g. in the form of service bundles/service

packages, cheques)

|

E3

|

|

45.1.

|

Technology vouchers as a measure for production digitisation

|

E3

|

|

45.2.

|

Support projects

|

E3

|

|

46.

|

Uninterrupted support for digitisation and/or technological audits

(vouchers)

|

E3

|

|

46.1.

|

Preparation of support schemes for digitisation and/or technological

audits (vouchers)

|

E3

|

|

46.2.

|

Implementation

|

E3

|

|

47.

|

Support for attracting and retaining specialists, professional internships,

qualification improvement, training and retraining

|

E3; P2; P3

|

|

47.1.

|

Preparation of schemes for training at a workplace

(apprenticeship/vocational training) to obtain knowledge in working with

digital technologies

|

E3; P2; P3

|

|

47.2.

|

A voucher for the development of skills in working with digital

technologies

|

E3; P2; P3

|

|

47.3.

|

Implementation

|

E3

|

|

48.

|

Support for expansion of Digital Innovation Hubs (DIHs) and

integration in national and international networks

|

E3; I1

|

|

48.1.

|

Preparation of a measure for the extension of DIHs

|

E3; I1

|

|

48.2.

|

Implementation

|

E3; I1

|

5.

CONCLUSIONS AND RECOMMENDATIONS

The country's competitiveness is directly proportional to

the country's level of economic development. According to SWOT analysis, general strengths

on which Moldovan industry digitalisation will rely can be distinguished. It

relies on the fact that manufacturing sector output is increasing – the

contribution of the manufacturing sector to national GDP is around 12%, however it is on the lower side

compared to other EU countries. Despite that, recent years indicate the rise of the output of this

industry segment and industry digitisation will further encourage this process.

Secondly,

public and private IRT infrastructure is well-developed – is consistently

updated, provides world-class internet access, and allows faster digitization. Thirdly,

the growing capacity of digitization solutions providers - supply a wide range

of services by participating in local and global value chains.

Industry digitalization

will address weaknesses such as SMEs dominate the local industry with low-level

technology readiness, which currently limits investment in the overall

advancement of manufacturing.

Secondly, production is

dominated by contract manufacturing of low value-added products, which limits

the need for cutting-edge technological solutions and does not require much

cooperation between Moldovan research and industry.

Thirdly, discrepancies

appeared between academia and industry's needs and the digitization incentives

system is fragmented and has many elements with poorly functioning links between

them. Moreover, partnership culture develops slowly and hinders collaboration

and cooperation between major actors in the ecosystem and ordinary B2B

relationships.

Implementing these

measures are expected to grant the following benefits:

· Higher rankings/better ratings across a range of indicators

that measure the state's performance in digitization and/or innovation at

European level and globally

· An increased number of companies carrying out innovation

activities

· An increased number of companies that benefit from tax

reliefs

· A growing share of GDP generated by high-tech companies

· An increasing number of employees working in high-tech

companies

· A more effective innovation system

· Better adaptation to pan-European and global standards

· New services for businesses

· The national network of Digital Innovation Hubs that

provide specialized digitization services

· An increased ratio of medium to high-tech companies

compared to all companies

· An increased number of registered patents

· A reduced regulatory burden for companies carrying out

innovation activities

· An increased number of PhDs working in the field of

industry digitization

· Reviewed and updated study programmers

· New and interdisciplinary study programmers in relation to

industry digitization

· New scientific and technology demonstration equipment

· An increased number of professionals attracted to industry

from abroad

· Increased private company investments in innovation

activities

· Increased added-value generated by manufacturing

enterprises

· Increased manufacturing companies' turnover

· An increased number of projects funded via public-private

partnerships

· An increase of exports in identified value chains

· An increased number of companies that benefited from state

support to get involved in international value chains.

6.

REFERENCES

Balabash O., Ilin V., Poprozman N.,

Kuznetsova I., Shushpanov D., & Slavina N. (2021). Content Strategy in

Management of Communications. Independent

Journal of Management & Production, 12(3), s232-s242. DOI: https://doi.org/10.14807/ijmp.v12i3.1538.

Bickauske, D.,

Simanaviciene, Z., Jakubavicius, A., Vilys, M. & Mykhalchyshyna, L. (2020). Analysis and

Perspectives of the Level of Enterprises Digitalization (Lithuanian Manufacturing

Sector Case). Independent

Journal of Management & Production, 11(9), 2291-2307.

DOI: http://dx.doi.org/10.14807/ijmp.v11i9.1404

Bogner, A., Littig, B., & Menz, W. (2009) Introduction: Expert

Interviews - An Introduction to a New Methodological Debate. Palgrave

Macmillian, New York, 1–13, 2009. DOI:

10.1057/9780230244276_1

Competitive Industrial Performance Index (2020). UNIDO Statistics

Data Portal. Available online: http://stat.unido.org/country/MDA.pdf

Duarte, C., & Ebert, C. (2018). Digital Transformation. IEEE

Software. 35. 16-21. DOI: 10.1109/MS.2018.2801537.

Esser, K., Hillebrand, W., Messner, D. & Meyer-Stamer, J. (2008).

Systemic Competitiveness: a New Challenge for Firms and for Government. Milestones in a Process of Innovation,

Change and Development. Special Edition: Buenos Aires/Dortmund, 21–26.

Filó, C. (2007). Territorial Competitiveness and the Human Factors. International

Conference of Territorial Intelligence, Huelva 2007 (CAENTI). Retrieved

from http://www.territorial–intelligence.eu. Access: 12 July, 2021.

Global

Competitiveness Index report, (2019). World Economic

Forum. Retrieved from http://www3.weforum.org/docs/WEF_TheGlobalCompetitivenessReport2019.pdf. Access: 29 July, 2021.

Hoellthaler, G., Braunreuther, S., & Reinhart, G. (2018). Digital

Lean Production an Approach to Identify Potentials for the Migration to a

Digitalized Production System in SMEs from a Lean Perspective. Procedia

CIRP, 67, 522–527. DOI: 10.1016/J.PROCIR.2017.12.255.

Kallioras, A., Pliakas, F.,

Diamantis, I., & Kallergis, G. (2010). SWOT analysis in groundwater resources management of coastal aquifers: a

case study from Greece. Water Int.,

35(4), 425–441. DOI:10.1080/02508060.2010.508929.

Kilimis, P., Zou, W., Lehmann, M., & Berger, U. A. (2019). Survey on

Digitalization for SMEs in Brandenburg, Germany, IFAC-PapersOnLine, 52

(13), 2140–2145.

Krugman, P. (1994). Competitiveness: a Dangerous obsession. In:

Competitiveness. An International Economics Reader, N.Y.: Foreign Affairs,

1994, Р. 1–17.

Leão de Miranda, R., Irgang dos

Santos, L. F., Giancarlo Gomes, G., & dos Santos Parisotto, I. R. (2021). Competitivness influence on global innovation of

nations: a cross-sectional analysis. Independent Journal of Management &

Production, 12(4), 964–978. DOI: 10.14807/ijmp. v12i4.1338.

Mainali, B., Ngo, H., Guo, W., Pham, T., Wang, X. C., & Johnston, A.

(2011). SWOT analysis to assist identification of the critical factors for the

successful implementation of water reuse schemes. Desalin Water Treat,

32(1–3), 297–306. DOI:10.5004/dwt.2011.2714.

Marinović Matović, I.

(2017). Impact of refugee crisis

on tourism development: Evidence from

Republic of Serbia. Second International

Thematic Monograph – Thematic Proceedings: Modern management tools and economy of

tourism sector in present era, Belgrade, pp. 628-644.

Okano, M. T., Antunes, S. N.,

& Fernandes, M. E. (2021). Digital

transformation in the manufacturing industry under the optics of digital

platforms and ecosystems. Independent Journal of Management &

Production, 12(4), 1139-1159. DOI: https://doi.org/10.14807/ijmp.v12i4.1375.

Porter, M. E. (1980). Competitive strategy: Techniques for analyzing

industries and competitors. In: New York: free press.

Porter, M. E. (1990). The competitive advantage of nations. Harvard

Business Review. In: March-April.

Porter, M., E. (2012). Regional Competitiveness and the Role of

Business. Harvard Business School, Mexico. Access: 15 July, 2021.

http://www.isc.hbs.edu/pdf/2012-0427---Michael_Porter_Puebla.pdf.

Puraite, A.,

Zuzeviciute, V., Bereikiene, D., Skrypko, T., & Shmorgun, L. (2020). Algorithmic

Governance in Public Sector: Is Digitization a Key to Effective Management. Independent

Journal of Management & Production, 11(9), 2149-2170. DOI:

http://dx.doi.org/10.14807/ijmp.v11i9.1400.

Rakauskiene G., & Tamošiūnienė, R. (2013). Factors

influencing national competitiveness. Business: Theory and Practice,

14(3), 177–187.

Schallmo D., Williams C., & Boardman, L. (2018). Digital

Transformation of Business Models. Best Practice, Enabler, and Roadmap. International

Journal of Innovation Management, 21(8), 1740014. DOI: https://doi.org/10.1142/S136391961740014X.

Ślusarczyk, B. (2018). Industry 4.0 – Are we ready? Polish

Journal of Management Studies, 17(10), 232–248.

DOI:10.17512/pjms.2018.17.1.19.

Smith, A. (1937). An Inquiry into the Nature and Causes of the Wealth of

Nations. The Modern Library.

Statbank (2020). Statistical databank. Retrieved from http://statbank.statistica.md/pxweb/pxweb/en/40%20Statistica%20economica/40%20Statistica%20economica__13%20CNT__SCN2008__CNT010__Resurse/CNT010072.px/table/tableViewLayout1/?rxid=9a62a0d7-86c4-45da-b7e4-fecc26003802%22%20class=%22link_mail.

Statbank, (2020a). Statistical databank. Retrieved from http://statbank.statistica.md/pxweb/pxweb/en/40%20Statistica%20economica/40%20Statistica%20economica__14%20IND__IND020/IND020100.px/table/tableViewLayout1/?rxid=b2ff27d7-0b96-43c9-934b-42e1a2a9a774. Access: 19 July, 2021.

Statbank, (2021). Statistical databank. Retrieved from http://statbank.statistica.md/pxweb/pxweb/en/40%20Statistica%20economica/40%20Statistica%20economica__14%20IND__IND010__serii%20anuale/IND010200.px/table/tableViewLayout1/?rxid=ff9b9e33-ef0e-4a49-b838-bd2be6251594. Access: 17 July, 2021.

The Global Competitiveness Report 2017-2018, World Economic Forum

2017. Retrieved from https://www.weforum.org/reports/global-competitiveness-report-2017-2018. Access: 10 July, 2021.

Ulas, D. (2019). Digital Transformation Process and SMEs. Procedia

Computer Science, 158, 662-671.

Wang, S., Wan, J., Zhang, D., Li, D., & Zhang, C. (2016). Towards

smart factory for industry 4.0: a self-organized multi-agent system with big

data-based feedback and coordination, special issue: Industrial Technologies

and Applications for the Internet of Things, 101, 158–168. DOI:

https://doi.org/10.1016/j.comnet.2015.12.017.

World Competitiveness Ranking, The Institute for Management

Development (IMD), 2017. Retrieved from https://www.imd.org/centers/world-competitiveness-center/rankings/world-competitiveness/. Access: 15 July, 2021.

World Digital Competitiveness Ranking, The Institute for Management

Development. Retrieved from https://www.imd.org/centers/world-competitiveness-center/rankings/world-digital-competitiveness/. Access: 14 July, 2021.

World Digital Competitiveness WDC (2017). The Institute for

Management Development. Retrieved from https://www.imd.org/centers/world-competitiveness-center/rankings/world-digital-competitiveness/. Access: 12 July, 2021.

Zalizko, V. D., Kanan, S. H., & Poprozman, N.

V. (2018). Economic and

Financial Security of Azerbaijan in the Context of Institutional Convergations. Financial and Credit Activity-Problems of Theory and

Practice, 2(25),

278-287. DOI: 10.18371/FCAPTP.V2I25.136867.

DIGITAL

TRANSFORMATION AS A FACTOR OF ENSURING COUNTRY COMPETITIVENESS: MOLDOVA CASE

ANALYSIS

DIGITAL

TRANSFORMATION AS A FACTOR OF ENSURING COUNTRY COMPETITIVENESS: MOLDOVA CASE

ANALYSIS