The study presents evidence of the use of

transfer pricing mechanisms by Ukrainian companies to optimize income taxation,

which is contrary to the interests of the state. Therefore, a special need

consists in improvement of the state control over operations of the foreign

economic activity. The changes and current trends in foreign economic

operations during the implementation of transfer pricing controls since 2013 in

accordance with the BEPS plan were examined. This study proves that immediately

after expanding the list of low tax jurisdictions, there has been a significant

fall in the volume of controlled exports and imports, which we regard as a loss

of cost-effectiveness of trade operations through low tax jurisdictions due to

increased controls and enlarged list of territories, transactions through which

are under strict control.

Keywords: Transfer pricing audit; Foreign economic activity; Finance of

international companies; Offshore; Low-tax jurisdictions; BEPS-plan

1.

INTRODUCTION

The European integration processes

that have been running in Ukraine over the last years frame the task of the

European Union (EU) standards implementation into management of transfer

prices’ auditing and control of foreign economic operations of international

companies. The gradual implementation of the Organization for Economic

Co-operation and Development’s (OECD) roadmap to counteract tax bases erosion

and income tax evasion is carried out by adapting the requirements of the Tax

Code of Ukraine (TCU) to European standards in the field of transfer pricing

control and special control of operations performed with contractors from

offshore territories.

The implementation of the OECD

roadmap to counter tax base erosion and income tax evasion (BEPS – Base Erosion

and Profit Shifting) is supposed to limit uncontrolled exports and imports,

reduce the number of tax-evaded incomes and positively affect tax revenues from

foreign economic activities.

The implementation of the BEPS plan

has begun in Ukraine since 2013 and continues today through more expanded

requirements introduced into taxation and audit of foreign economic activities

in accordance with the OECD standards. Since 2017 four of fifteen steps of the

BEPS plan have been introduced in Ukraine to resist various areas of aggressive

tax planning: combating tax abuse related to the application of special tax

regimes; elimination of abuses while implementing tax conventions; disclosure

of the use of aggressive tax planning schemes; improving the effectiveness of

dispute settlement mechanisms related to the application of double tax

avoidance treaties between countries.

The implementation of the BEPS plan

is primarily made through frame working a transfer pricing control system in

Ukraine, which aims to reduce illegal tax sheltering through foreign economic

transactions with interdependent or interested parties as well as through

transactions with contractors that are registered or make business in low-tax

jurisdictions. The enforcement of a transfer pricing control system will lead

to an increase in tax revenues to the country's budget in accordance with the

tax legislation of Ukraine.

2.

LITERATURE REVIEW

Many foreign publications deal with

the issues of avoiding taxation through offshore territories by means of

transfer pricing mechanisms. The question of transfer pricing control and

management in the context of tax optimization was investigated by DEVEREUX and MAFFINI

(2007), LOHSE and RIEDEL (2013), MARQUES and PINHO (2015), RUF AND

WEICHENRIEDER (2015), HUDA, NUGRAHENI and KAMARUDIN (2017), MELNYCHENKO,

PUGACHEVSKA and KASIANOK (2017) PRETTL (2018), BEEBEEJAUN (2019), CLIFFORD

(2019), HIRA, MURATA and MONSON (2019).

These studies also include

investigation various aspects of the implementation of European standards into

the system of audit of transfer prices and operations through offshore zones.

In the study of HUDA, NUGRAHENI and KAMARUDIN (2017) the issue of transfer

pricing control in the Indonesian tax system is researched, which concludes

that transfer pricing schemes are used by multinational companies to avoid tax

payments by transferring their tax liabilities to other countries with lower

tax rates.

A similar conclusion is reached by MELNYCHENKO,

PUGACHEVSKA and KASIANOK (2017), who argue that the transfer price generated by

a multinational company between two units is an economic and legal tool used to

optimize the tax burden. LOHSe and RIEDEL (2013) published results of a study

assessing the impact of transfer pricing rules on the behavior of multinational

companies in intra-group price distortions, where the authors argue that the

introduction of certain transfer pricing rules increases the profits that are

reflected in the profitability of businesses in high tax jurisdictions, and

reduce them in low tax jurisdictions.

MARQUES and PINHO (2015) argue that

increasing rigidity in transfer pricing regulation reduces the sensitivity of

reported earnings to differences in tax rates. But there are also critics of

tightening transfer pricing controls for AVI-YONAH, CLAUSING and DURST (2009),

who believe that such rules only complicate the management process and increase

the cost of preparing a transfer pricing report.

Some studies have revealed the

experience of implementing the BEPS plan and the relevant requirements for

auditing the foreign economic activities of multinationals. In particular, WEST's

(2017) scientific work focuses on the introduction of the BEPS and CRS (Common

Reporting Standards) plan in South Africa and their influence on the domestic

legislation. The issue of offshore zones and transfer pricing are investigated

not only in the field of tax control over these processes, but also from the

side of evaluating the effectiveness of offshore transactions performed by the

entities conducting such operations. Thus, LARSEN (2015) studies errors while

estimating the cost of offshore operations and the impact of these errors on

the performance of individual units.

Researching the OECD's gradual

implementation of the BEPS plan, ECCLESTON and SMITH (2016) make an interesting

conclusion in their work by arguing that BEPS will not succeed in its attempts

to restrict the growing aggressive tax planning practices of multinational

corporations. These researches state that while assessing issues of control

related to international taxation, it is necessary to outline the conceptual

differences (and political implications) between facilitation of international

tax transparency, on the one hand, and regulation of international tax

competition that makes tax evasion possible, on the other.

But most authors are CLIFFORD

(2019), RUF and WEICHENRIEDER (2015), PRETTL

(2018), DEVEREUX and MAFFINI (2007) agree that the implementation of transfer

pricing controls has a positive effect on tax revenues and the behavior of

multinational companies in the field of tax optimization: forcing TNCs to

profit from the high tax jurisdictions in which they were actually established;

changing the structure of enterprise groups towards reducing the number of

subsidiaries in low-tax jurisdictions; there is an increase in tax revenues in

countries that enforce transfer pricing controls.

Studies of the process of the

European standards implementation into the system of audit and taxation of

foreign economic activities of Ukraine are made in different directions. In

particular, scientists IVASHOVA and IVASHOV (2014), upon having made an

analysis of the EU experience in the sphere of state control and directions of

its implementation in Ukraine, identified a number of material, technical,

organizational, information and personnel support issues and specified the

directions of improving the work of government control and audit services,

which, in our opinion, can be used for improving the state control of foreign

economic activities of enterprises as well.

The introduction of European

standards into the system of audit of foreign economic activities of Ukraine is

closely connected with the development of Customs post-audit. So, the works of PETRYK

and MARYNICH (2015) look into the issue of Customs post-audit creation in

Ukraine, in which the authors conclude that the introduction of Customs

post-audit control is an essential condition for further integration of the

Ukrainian economy into the European community and consider it necessary to

involve audit companies in Customs post-audit control. This will allow reaching

the level of the best world practices concerning the maximum reduction of time

spent on Customs clearance and will ensure constant compliance with Customs

legislation by foreign trade participants.

VAKULCHYK, FESENKO and KNYSHEK (2017)

study the features of the audit of compliance of the enterprises carrying out

foreign economic activity with the European standards of the Authorized

Economic Operator, which makes it possible to offer a model of assessment of an

enterprise’s compliance with these requirements and which is already a

methodological basis for enterprises’ self-assessment of their status in

accordance with European standards.

Separately, some scientific works

have revealed the issues of creation of transfer pricing control in Ukraine

since 2013. In particular, the works of ALEKSEEVA (2014), VAKULCHYK (2016),

PETRYK (2016), FESENKO (2018) describe the experience of Ukraine in the field

of transfer pricing control, the main tendencies and prospects of its

development, which is also significant for the implementation of European

standards into the control and audit of foreign economic activity of

enterprises.

Despite the considerable

achievements in making an analysis of the process of the European standards

implementation into the legislation of different countries with a transition

economy as well as the BEPS plan introduction in Ukraine, modern publications

almost do not study the economic effect of the European standards implementation

into auditing and taxation of foreign economic activities of Ukraine.

Therefore, we consider it feasible to investigate the evolution of the main

economic indicators, which may identify positive changes and reduction of abuse

and fraud within foreign trade operations in Ukraine.

Based on the abovementioned, the

purpose of the research is to evaluate the impact of the adaptation of

European requirements in sphere of management of transfer price’s audit on the

volume and structure of foreign economic activities of Ukraine and to identify

current trends in the management of foreign economic operations of groups of

international companies.

3.

METHODOLOGY

The methodological basis of the

study are the fundamental provisions of modern economic science, a set of general

and special methods of cognition, in particular: the method of induction and

deduction (to determine the criteria for attributing countries to low-tax

jurisdictions), the method of systematic approach (to summarize and systematize

the results of analysis and analysis of the results of analysis), a method of

comparing and structuring analysis of Ukraine's statistics (in determining the

top 10 countries of export and import to (from) low tax jurisdictions).

The study is based on data from the

State Statistics Committee of Ukraine, the State Fiscal Service of Ukraine. The

study was conducted on the basis of data for 2015-2019.

4.

RESULTS AND DISCUSSIONS

One of the directions of control and

regulation under the BEPS plan is an expanded list of jurisdictions, trade

operations with which residents are subject to tighter control by the State

Fiscal Service of Ukraine. Within the framework of implementation of the rules

of transfer pricing control into the legislation of Ukraine, business

transactions carried out with non-residents registered in the states

(territories) included in the relevant list of the Cabinet of Ministers of

Ukraine are subject to careful audit. Together with the entry into force of the

relevant laws and regulations of the Tax Code of Ukraine, special rules to

regulate transactions with contractors registered and paying taxes in countries

with low income tax rates are introduced.

Thus, Ukraine has adopted a number

of normative documents to specify the list of states and territories (offshore

zones), transactions with which are subject to state tax control.

These documents list the states and

territories, transactions with which residents are considered controlled.

An important task is to determine

whether tightening control actually results in the consequent reduction of

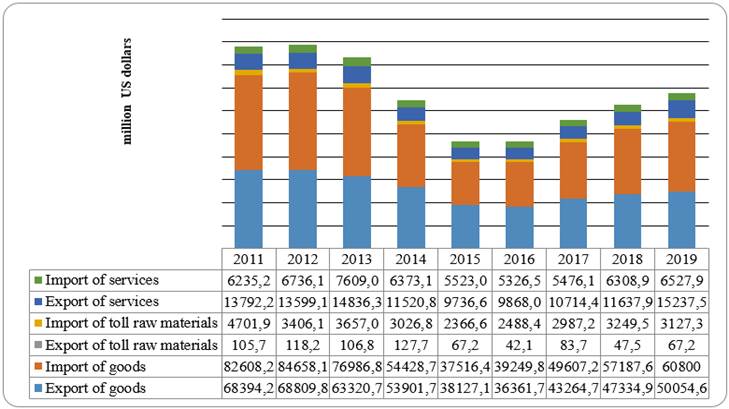

exports and imports through low-tax jurisdictions. To assess the overall dynamics of foreign economic activity in Ukraine,

it is advisable to demonstrate the volume of foreign trade in Ukraine in recent

years (figure 1).

Figure 1:

Dynamics of foreign trade in goods, services and toll raw materials in Ukraine

(million USD)

Source: calculated by authors on the data of State Statistics Service of

Ukraine

The total amount of foreign trade in

2011 and 2012 was almost at the same level (175837.4 and 177327.4 million US

dollars), but since 2013 the volume of foreign trade is gradually declining and

reaches a minimum in 2016 - 93336.5 million dollars USA.

The failure in foreign trade in

2013-2016 is explained by the known reasons of military-political and economic

nature, which became the main negative factors influencing the level of foreign

economic activity of Ukraine. Since 2017, there has been a gradual increase in

Ukraine's total foreign trade, but even in 2019 Ukraine did not reach the level

of 2011-2012.

Figure 2 shows the volume of

Ukrainian exports to low-tax jurisdictions during 2018. The largest volume of

exports among the countries recognized by the Cabinet of Ministers of Ukraine

as low-tax jurisdictions in 2018 were reported to be brought into Bulgaria,

Iran, Spain, Singapore, Lebanon, Moldova, Morocco, Serbia, Uzbekistan, the UAE.

Along with the expansion of the list

of states and territories (offshore zones), trade operations with which are

subject to the state tax control, the volume of exports to these territories

changes as well.

Figure 2: Exports from Ukraine to low-tax jurisdictions (according to the Cabinet

of Ministers of Ukraine list) during

2018, thousand US dollars

Source: calculated by authors

on the data of State Statistics Service of Ukraine

Table 1 lists low-tax jurisdictions

with the largest export volumes during 2016-2019.

Table 1: TOP-10 low-tax jurisdictions by volume

of exports from Ukraine during 2016-2019

|

2016

|

2017

|

2018

|

2019

|

|

Country

|

Amount, thousand US dollars

|

Country

|

Amount, thousand US dollars

|

Country

|

Amount, thousand US dollars

|

Country

|

Amount, thousand US dollars

|

|

The Republic of Moldova

|

481145.4

|

The Republic of Moldova

|

707583.5

|

The Republic of Moldova

|

789204.3

|

The Republic of Moldova

|

726568.7

|

|

Bulgaria

|

418193.3

|

Bulgaria

|

429904.9

|

Bulgaria

|

513862.3

|

The United Arabic

Emirates

|

525937.3

|

|

Serbia

|

156132.5

|

Uzbekistan

|

167113.3

|

The United Arabic Emirates

|

486162.9

|

Bulgaria

|

482168.2

|

|

Uzbekistan

|

142392.7

|

Serbia

|

156132.5

|

Iran

|

433092.6

|

Lebanon

|

372125.0

|

|

Turkmenistan

|

108981.9

|

Malaysia

|

130670.2

|

Lebanon

|

404839.5

|

Morocco

|

294070.2

|

|

Cyprus

|

53481.4

|

Cyprus

|

79637.6

|

Morocco

|

363207.9

|

Uzbekistan

|

215821.1

|

|

Oman

|

51870.5

|

Turkmenistan

|

62142.3

|

Uzbekistan

|

286023.2

|

Iran

|

214727.4

|

|

Hong

Kong

|

49013.4

|

Ireland

|

55298.4

|

Singapore

|

165717.1

|

Singapore

|

188523.8

|

|

Ireland

|

45483.9

|

Hong

Kong

|

54074.8

|

Serbia

|

156132.5

|

Malaysia

|

181606.2

|

|

Kyrgyzstan

|

40430.8

|

Oman

|

51870.5

|

Malaysia

|

125583.4

|

Ireland

|

153235.2

|

Source: calculated by authors on the data of

State Statistics Service of Ukraine

Figure 3 shows the volume of

imported goods to Ukraine in 2018 from the countries included in the list of

low-tax jurisdictions in accordance with the Cabinet of Ministers of Ukraine

Decree No. 1045 from December 27, 2017.

Figure 3: Import volumes to Ukraine from

low-tax jurisdictions during 2018, thousand US dollars

Source:

calculated by authors on the data of State Statistics Service of Ukraine

The largest volumes of imports among

the countries included by the Cabinet of Ministers of Ukraine in the list of

low-tax jurisdictions in 2018 were reported from Spain, Malaysia, Turkmenistan,

Ireland, Uzbekistan, Moldova, Hong Kong, Guatemala, Iran, the UAE.

Table 2 shows the low-tax

jurisdictions, the largest volumes of imports from which were identified during

2016-2019.

Table 2 shows that among the

countries included in the list of low-tax jurisdictions in the respective years

leading importers by volume of goods brought into Ukraine are Bulgaria (the

first place in 2016 and 2017), Malaysia (the second place in 2017 and the first

place in 2018), Ireland, Turkmenistan, and Uzbekistan.

Table 2: TOP-10 low-tax jurisdictions by volume of imports to Ukraine during

2016-2019

|

2016

|

2017

|

2018

|

2019

|

|

Country

|

Amount, thousand US dollars

|

Country

|

Amount, thousand US dollars

|

Country

|

Amount, thousand US dollars

|

Country

|

Amount, thousand US dollars

|

|

Bulgaria

|

172873.8

|

Bulgaria

|

189933.3

|

Malaysia

|

230291.1

|

Bulgaria

|

459341.9

|

|

Serbia

|

106506.9

|

Malaysia

|

189904.4

|

Turkmenistan

|

144407.9

|

Malaysia

|

230331.3

|

|

Ireland

|

84712.5

|

Uzbekistan

|

122721.1

|

Ireland

|

143826.1

|

Ireland

|

169564.7

|

|

Uzbekistan

|

71060.2

|

Ireland

|

113890.3

|

Uzbekistan

|

121381.1

|

Uzbekistan

|

112740.8

|

|

The

Republic of Moldova

|

47623.2

|

The

Republic of Moldova

|

106719.5

|

The

Republic of Moldova

|

118076.0

|

Morocco

|

100549.7

|

|

Turkmenistan

|

34336.1

|

Guinea

|

97788.9

|

Hong

Kong

|

108085.0

|

The

Republic of Moldova

|

91250.6

|

|

Qatar

|

26268.8

|

Turkmenistan

|

89345.8

|

The

United Arabic Emirates

|

79227.0

|

Hong

Kong

|

87692.7

|

|

Cyprus

|

22081.6

|

Hong

Kong

|

29120.1

|

Singapore

|

65016.0

|

Turkmenistan

|

82964.6

|

|

Hong

Kong

|

17629.9

|

Cyprus

|

20527.1

|

Guatemala

|

54288.4

|

The

United Arabic Emirates

|

80544.8

|

|

Bosnia

and Herzegovina

|

10776.0

|

Bosnia

and Herzegovina

|

12491.3

|

The

Islamic Republic of Iran

|

53854.8

|

The

Islamic Republic of Iran

|

48956.2

|

Source:

calculated by authors on the data of State Statistics Service of Ukraine

At the stage of introduction of

transfer pricing control mechanisms, the list of territories considered as

offshore zones was added and the Decree of the Cabinet of Ministers of Ukraine

from December 25, 2013 No. 1042-p significantly increased the number of states,

transactions with which residents are subject to state control (Table 3).

As it can be seen from Table 3, the

number of states and territories subject to state control changes quite often

due to the adoption of new regulations. Major changes for international

business happened in 2014, when the number of such areas increased rapidly from

36 up to 73 countries.

Studying the territorial aspects of

foreign economic activity of business entities in Ukraine over the years, it

should be highlighted that this expansion has significantly raised the amount

of controlled transactions. In particular, in 2014 the number of states from

the list of offshore zones used for foreign economic activity of entities grew from

14 up to 35 compared to 2013.

Table 3: The ratio of the number of states

(territories), transactions with which are controlled by a state in accordance

with the legislation of Ukraine

|

Indicators

|

The reporting period under study, for which

business entities are required to provide information on controlled

transactions (years)

|

|

2013

|

2014

|

2015

|

2016

|

2017

|

2018

|

|

The number of offshore states (territories)

from the list involved in export-import of Ukraine

|

14

|

35

|

38

|

32

|

29

|

39

|

|

The statutory document defining the list of

offshore territories

|

The

Decree of the Cabinet of Ministers of Ukraine No. 143-r from February 23,

2011

|

The

Decree of the Cabinet of Ministers of Ukraine No. 1042-ð from December 25,

2013

|

The

Decree of the Cabinet of Ministers of Ukraine No. 977-ð from September 16, 2015

|

The

Resolution of the Cabinet of Ministers of Ukraine No. 1045 from December 27,

2017

|

|

The number of states (territories) included

in the list

|

36

|

73

|

73

|

65

|

65

|

85

|

|

Percentage of enterprises involved in foreign

economic activities of Ukraine according to the Cabinet of Ministers of

Ukraine list, %

|

39

%

|

48

%

|

52

%

|

49%

|

45

%

|

45.9

%

|

Source:

calculated by the authors

During 2016-2018 from 29 up to 39

offshore zones were used for foreign economic operations of Ukrainian business

entities, which is about half of the offshore zones controlled by the state

(Table 4).

Table 4: The indicators of export-import of

goods of Ukraine to (from) countries (territories), transactions with which are

controlled by the government

|

The

indicators of export/import of goods

|

The

period under study (years)

|

|

2015

|

2016

|

2017

|

2018

|

|

Volumes

of exported goods of Ukraine, thousand US dollars

|

38,127,150

|

36,361,711

|

43,264,736

|

47,334,987

|

|

Volumes

of exported goods to the countries (territories) from the Cabinet of

Ministers of Ukraine list, thousand US dollars

|

3,130,862

|

1,650,089

|

2,044,867

|

5,586,273

|

|

The

share of exports to offshore zones in the total amount of exports of

Ukraine,%

|

8.21

|

4.54

|

4.72

|

11.8

|

|

Volumes

of imported goods of Ukraine, thousand US dollars

|

37,516,443

|

39,249,797

|

49,607,174

|

57,187,578

|

|

Volumes

of imported goods from the countries (territories) included in the Cabinet of

Ministers of Ukraine list, thousand US dollars

|

1,422,573

|

610,111

|

1,000,680

|

1,843,434

|

|

The

share of imports from offshore zones in the total amount of imports of

Ukraine,%

|

3.79

|

1.55

|

2.02

|

3.22

|

Source:

calculated by authors on the data of State Statistics Service of Ukraine

It is interesting that along with

the increase in the number of controlled offshore zones in 2014, the share of

export of goods to the countries from the list of offshore zones in the total

amount of export of Ukraine grew (from 0.95% up to 8.57%). As mentioned above,

the number of territories considered as being controlled by the government in

2014 increased from 14 up to 35 compared to 2013 (Table 3).

At the same time, in 2014 there was

seen the growth in the share of exports and imports to (from) territories, the

trade operations with which are considered state controlled, in the total

volume of exports (imports) of Ukraine (Table 4).

It is interesting to point out that

in 2018 Cyprus, which is a well-known offshore area, did not rank in top-10

low-tax jurisdictions. However, export to Cyprus has not stopped for many

years. It means that even if tax control becomes tighter, the interest of

entities involved in foreign trade in the opportunities offered by low-tax

jurisdictions (tax allowances, simplified accounting, taxation and reporting,

etc.) does not decrease.

The list of offshore areas shifts

from time to time and in different countries these areas may be located in

various territories and states. In general, an offshore zone is defined as a

free economic zone with particularly favorable currency-financial and fiscal

regimes, a simplified system of taxpayers’ registration, a high level of

confidentiality and loyalty of state control and regulation. Typically,

offshore areas have low or zero tax rates as well as simplified licensing

conditions.

Some countries draw up an

appropriate lists of offshore zones, which are more thoroughly controlled. They

include black, grey and white lists of offshore zones. The white list consists

of those countries that, though having simplified taxation and registration

conditions, sign relevant economic treaties on tax information sharing. The

grey list of offshore zones includes those countries that sign a slight number

of economic agreements on tax information sharing or are just about to do so.

The black list is a list of territories and states with significant tax

simplifications, suspected of money laundering and refusing to provide

additional tax information.

Each country has its own black list

of offshores, which is updated annually. Most countries include the Bahamas,

Barbados, Cyprus, Monaco, Jersey, the Isle of Man and others in it.

Branches in such

countries or transactions with their residents lead to additional tax control

and in some countries even additional taxation.

Foreign

economic transactions with residents from such territories create a conflict of

interests between a business and a state, which means opposite interests

(entities prefer to choose territories with tax allowances and simplified

regulation to make their business, while a state fights to receive appropriate

income tax revenues).

The fact that the list of such

territories was supplemented according to the Cabinet of Ministers of Ukraine

Decree in 2013 confirms that enterprises of Ukraine actually performed a large

volume of foreign economic transactions with contractors from those territories

where income tax rates were significantly different (the difference

exceeded 5%). This means that until 2014

Ukrainian enterprises virtually sought for income tax evasion through

transactions in low-tax jurisdictions. The abovementioned trend in 2014 points

to the obvious consequence of relevant regulations adoption expressed in the

identification of significant volumes of exports and imports of local

enterprises to low-tax jurisdictions that earlier were controlled by the

government.

In 2015 and 2016 the volume of

exported goods to controlled offshore areas halved and their share reached

4.54% in the total amount of exports. The volume of imports from controlled

offshore areas is also decreasing and its share in the total amount of

Ukrainian import reaches 1.55%. Such a trend testifies the reduction in foreign

economic transactions previously carried out by local enterprises in low tax

jurisdictions. It shows that due to strengthened state tax control such

transactions have lost their cost-effectiveness. In 2017 decreasing of

controlled exports and imports to offshore territories continued, but in 2018 a

notable rise was reported – the share of exports to offshore zones in the total

amount of exports of Ukraine increased up to 11.8%, while the share of imports

from offshore zones in the total amount of imports rose up to 3.22%.

It is difficult to assess the effect

of controlled exports and imports growth on tax revenues increase. However,

within the execution of transfer pricing control some results of the State

Fiscal Service of Ukraine audits of foreign economic activities of enterprises

involving transfer pricing were reported, which testify to positive tendencies.

The first results of audits by the State Fiscal Service of Ukraine of the

reports on controlled transactions are presented and it is determined that in

the period from 2013-2016, 206 violations were established during the audits of

the reports on controlled transactions, after which the income tax amounted to

UAH 297.8 million. As a result of the audit of the documentation on transfer

pricing of Ukrainian enterprises in 2018, a profit tax of UAH 232 million was

reduced, losses were reduced by UAH 1.6 billion, and the tax base was

voluntarily increased by UAH 1.7 billion.

Results of audits of expediency and completeness of reports on

controlled operations for the reporting periods in 2013-2016 are in the table 5.

Table 5: Results of audits made by the State

Fiscal Service of Ukraine of expediency and completeness of reports on

controlled operations in 2013-2016

|

Indicators

|

Indicator values

|

|

Identified cases of non-submission/ delayed submission of reports on

controlled transactions and incomplete reporting of performed transactions in

submitted reports, cases

|

206

|

|

Penalties applied, mln. UAH

|

67,0

|

|

Of which budget revenues, mln. UAH

|

16,2 (24,2 %)

|

|

Taxpayers to whom requests for transfer pricing report submission have

been sent, taxpayers

|

60

|

|

Number of audits completed in 2017,

of which

|

23

|

|

exporters

of agricultural goods

|

10

|

|

industrial

producers (export / import)

|

8

|

|

food

producers

|

2

|

|

transfer

of intangible assets

|

1

|

|

IT services

|

1

|

|

maritime

leasing services

|

1

|

|

As a result of which income tax was accrued, mln. UAH

|

297,8

|

|

VAT, mln. UAH

|

1,4

|

|

Reduced negative value of taxable entity, mln. UAH

|

3715,2

|

|

Reduced amount of VAT reimbursement, mln. UAH

|

2,6

|

|

Reduced negative value of VAT, mln. UAH

|

0,4

|

|

The state budget received revenues from the tax on income, mln. UAH

|

65,6

|

|

The state budget received revenues from value added tax, mln. UAH

|

0,1

|

Source:

calculated by authors on the data of the State Fiscal Service of Ukraine

5.

CONCLUSIONS AND RECOMMENDATIONS

The current global DE

offshorization trend and European integration processes in Ukraine have

resulted in much tighter control over the transactions of international

companies. Consequently, it has significantly affected the volume and structure

of controlled exports and imports brought in and out by the entities engaged in

foreign economic activities in Ukraine.

The

analysis of changes in the legislation of Ukraine during adaptation to the

European standards has made it possible to conclude that since 2013 the

government list of low tax jurisdictions has significantly changed and expanded

from 36 in 2013 to 85 countries (territories) in 2018. However, only half of

the countries in the list are virtually involved in the foreign economic activity

of Ukraine.

The

deeper research has revealed that immediately after expanding the list of low

tax jurisdictions, there has been a significant fall in the volume of

controlled exports and imports, which we regard as a loss of cost-effectiveness

of trade operations through low tax jurisdictions due to increased controls and

enlarged list of territories, transactions through which are under strict

control. In 2018 the share of controlled exports and imports has increased

remarkably (from 4.72% in 2017 up to 11.8% in 2018 for exports and from 2.02%

in 2017 up to 3.22% in 2018 for import), which, in our opinion, has happened

because of a qualitative change in the list of low tax jurisdictions.

The

investigation of the structure of exports and imports by geographical segments

has identified top- 10 low-tax jurisdictions by volume of goods. Thus, during

2016-2018 among all low-tax jurisdictions mentioned in the government list, the

largest volumes of exports and imports was reported concerning the transactions

with contractors from Bulgaria. Other countries were Turkmenistan, Ireland and Hong Kong.

In general, the process of

implementing the steps of Plan BEPS in Ukraine is gradual and effective; there

is an improvement in legislation in the field of transfer pricing control,

international coordination procedures, in the field of avoidance of double

taxation and more. On January 1, 2017, Ukraine joined the Enhanced Cooperation

Program within the Organization for Economic Cooperation and Development and committed

itself to implementing the minimum standard of the Action Plan to combat the

erosion of the tax base and the withdrawal of profits from taxation.

Ukraine is obliged to implement four

steps out of the fifteen proposed, namely: step 5 “Improvement of measures to

combat tax abuse”; step 6 “Prevention of abuse of benefits provided by

bilateral agreements”; step 13 “Recommendations on transfer pricing and

disclosure documentation by country”; step 14 “Improving the mutual agreement

procedure by resolving disputes”.

The Ministry of Finance of Ukraine

has developed a roadmap for the implementation of the BEPS Action Plan, which

will implement the next steps of Plan BEPS, aimed at counteracting the erosion

of the tax base. Given Ukraine's clear course towards European integration, it

can be concluded that the procedures for strengthening control over exports and

imports to low-tax jurisdictions and control over transfer pricing will be

improved taking into account the new requirements of the Organization for

Economic Cooperation and Development.

REFERENCES

ALEKSJEJEVA, A., IGHNATENKO, T. (2014)

Transfertne tsinoutvorennia yak mekhanizm podatkovoho kontroliu [Transfer

pricing as a tax control mechanism]. Visnyk

Kyjivsjkogho nacionaljnogho torghoveljno-ekonomichnogho universytetu, v. 3,

p. 85-95. Available: http://nbuv.gov.ua/UJRN/Vknteu_2014_3_8. Access: 10 April

2020.

ANTONIUK, O.; CHYZHEVSKA, L.; SEMENYSHENA, N. (2019)

Legal regulation and trends of audit services: what are the differences

(evidence of Ukraine). Independent

Journal of Management & Production, v. 10, n. 7, p. 673-686. DOI:

http://dx.doi.org/10.14807/ijmp.v10i7.903.

AVI-YONAH, R., CLAUSING, K., DURST, M. (2009)

Allocating Business Profits for Tax Purposes: A Proposal to Adopt a Formulary

Profit Split. Florida Tax Review, v.

5, p. 497-553. Available: https://repository.law.umich.edu/articles/774/.

Access: 22 April 2020.

BEEBEEJAUN, A. (2019) The fight against

international transfer pricing abuses: a recommendation for Mauritius. International Journal of Law and Management,

v. 61, n. 1, p. 205-231. DOI: https://doi.org/10.1108/IJLMA-05-2018-0083

CLIFFORD, S. (2019) Taxing multinationals

beyond borders: Financial and locational responses to CFC rules. Journal of Public Economics, v. 173, p.

44-71. DOI:

https://doi.org/10.1016/j.jpubeco.2019.01.010

DERZHAVNA FISKALNA SLUZHBA UKRAINY (2017) Zvit pro vykonannia planu roboty Derzhavnoi

fiskalnoi sluzhby Ukrainy za 2017 rik [Report on the implementation of the

work plan of the State Fiscal Service of Ukraine for 2017]. Available: <http://sfs.gov.ua/data/files/223549.PDF>.

Access: 23 April 2020.

DERZHAVNA FISKALNA SLUZHBA UKRAINY (2018) Zvit Derzhavnoi fiskalnoi sluzhby Ukrainy

za 2018 rik [Report of the State Fiscal Service of Ukraine for 2018].

Available: <http://sfs.gov.ua/data/files/240396.pdf>. Access: 12 April 2020.

DEVEREUX, M.; MAFFINI, G. (Eds). (2007) Proceedings of European Tax Policy Forum

Conference «The Impact of Corporation Taxes across Borders». Oxford

University Centre for Business Taxation. Available: http://eureka.sbs.ox.ac.uk/3395/1/WP0702.pdf.

Access: 24 April 2020.

DISCHINGER, M. T.; RIEDEL, N. (2012) Corporate

Taxation and the Location of Patents within Multinational Firms. Journal of International Economics, v.

88, n. 1, p. 176-185. DOI: https://doi.org/10.1016/j.jpubeco.2010.12.002

ECCLESTON, R.; SMITH, H. (2016) The G20, BEPS

and the future of international tax governance. In P. Dietsch & T. Rixen

(Eds.). Global tax governance: What is

wrong with it and how to fix it (p. 175–198). Colchester: ECPR Press.

FESENKO, V. V. (2018) Zovnishnoekonomichni operatsii pidpryiemstva z poviazanymy storonamy:

audyt i analiz [Foreign economic transactions of an enterprise with related

parties: audit and analysis]. Dnipro: Dominanta print.

HIRA, A.; MURATA, B.; MONSON, S. (2019).

Regulatory Mayhem in Finance: What Panama Papers Reveal. In HIRA, A.; CAILLARD,

N.; COHN, T. H. (Eds.). The Failure of Financial Regulation (p.

191-232). Burnaby: Simon Fraser University.

HUDA, M.; NUGRAHENI, N.; KAMARUDIN, K. (2017)

The Problem of Transfer Pricing in Indonesia Taxation System. International Journal of Economics and

Financial Issues, v. 7, n. 4, p. 139-143. Available: <https://www.econjournals.com/index.php/ijefi/article/view/4793/pdf>.

Access: 12 April 2020.

INTERNATIONAL CONVENTION ON THE SIMPLIFICATION

AND HARMONIZATION OF CUSTOMS PROCEDURES. Available:

<http://zakon4.rada.gov.ua/laws/show/995_643/>. Access: 18 April 2020.

IVASHOVA, L. M.; IVASHOV, M. F. (2014) Dosvid

derzhavnoho finansovoho kontroliu v krainakh YeS ta napriamy yoho

implementatsii do Ukrainy [Experience of state financial control in the EU

countries and directions of its implementation in Ukraine]. Visnyk Akademii mytnoi sluzhby Ukrainy.

Seriia: Derzhavne upravlinnia, v. 2, n. 11, p. 12-23. Available:

<http://nbuv.gov.ua/UJRN/vamcudu_2014_2_4. Access: 12 April 2020>.

KHALATUR, S.; RADZEVICIUS, G.; VELYCHKO, L.;

FESENKO, V.; KRIUCHKO, L. (2019) Global deoffshorization and its impact on the

national and regional economies of eastern european countries. Problems and Perspectives in Management,

v. 17, n. 3, p. 293-305. doi:10.21511/ppm.

LARSEN, M. M. (2015) Failing to estimate the

costs of off shoring: A study on process performance. International Business Review, v. 25, n. 1, p. 307-318. DOI: https://doi.org/10.1016/j.ibusrev.2015.05.008.

LOHSE, T.; RIEDEL, N. (2013) Do Transfer

Pricing Laws Limit International Income Shifting? Evidence from European

Multinationals. CESifo Working Paper

Series No. 4404. Available: <https://ssrn.com/abstract=2334651>.

Access: 19

April 2020.

MARQUES, M.; PINHO, Ñ. (2015). Is transfer pricing

strictness deterring profit shifting within multinationals? Empirical evidence

from Europe. Accounting and Business

Research, v. 46, n. 7, p. 703-730. Available:

<https://ssrn.com/abstract=2709035>. Access: 21 April 2020.

MARQUES, M.; PINHO, Ñ.; MONTENEGRO, T. (2019) The effect

of international income shifting on the link between real investment and

corporate taxation. Journal of

International Accounting, Auditing and Taxation, v. 36. DOI:

https://doi.org/10.1016/j.intaccaudtax.2019.100268.

MELNYCHENKO, R.; PUGACHEVSKA, K.; KASIANOK, K.

(2017) Tax control of transfer pricing. Investment

Management and Financial Innovations, v. 14, n. 4, 40-49. DOI:

http://dx.doi.org/10.21511/imfi.14(4).2017.05.

CUSTOMS CODE OF UKRAINE (2012). Available:

<http://zakon3.rada.gov.ua/laws/show/4495-17>. Access: 22 April 2020

OECD TRANSFER PRICING GUIDELINES FOR

MULTINATIONAL ENTERPRISES AND TAX ADMINISTRATIONS. (2017). DOI:

https://dx.doi.org/10.1787/tpg-2017-en Available:

<http://www.svcmscentral.com/SVsitefiles/nlc/contenido/doc/073214_OECD%20TP%20Guidelines%20June%202010.pdf>.

Access: 05 May 2020.

OFITSIINYI SAIT DERZHAVNOI SLUZHBY STATYSTYKY

UKRAINY. Official site of the State

Committee of Statistics of Ukraine. Available:

<http//www.ukrstat.gov.ua>. Access: 12 May 2020.

PETRYK, O. A.; KASYCH, A. O.; GHRYNENKO, Ju. I.

(2016) Transfertne tsinoutvorennia na pidpryiemstvi: problemy ta mozhlyvosti

vykorystannia [Transfer pricing in the enterprise: problems and opportunities

for use]. Investyciji: praktyka ta

dosvid, n. 24, p. 19-23. Available: <http://nbuv.gov.ua/UJRN/ipd_2016_24_6>.

Access: 26 April 2020

PETRYK, O. A.; MARYNICH, I. O. (2015) Rol

nezalezhnoho audytu v provedenni post-mytnoho kontroliu [The role of

independent audit in post customs control]. Technology audit and production reserves, v. 1/6, n. 21, p. 57-60.

Available: <http://journals.uran.ua/tarp/article/view/38439>. Access: 19 April 2020.

PRETTL, A. (February 2018). Profit Shifting & Controlled Foreign

Corporation Rules – the Thin Bridge between Corporate Tax Systems. DOI:

http://dx.doi.org/10.2139/ssrn.3102553

RAKHUNKOVA PALATA UKRAINY. (2016) Zvit pro rezultaty audytu efektyvnosti

vykonannia povnovazhen terytorialnymy orhanamy Derzhavnoi fiskalnoi sluzhby za

dotrymanniam subiektamy hospodariuvannia, yaki zdiisniuiut zovnishnoekonomichnu

diialnist, zakonodavstva Ukrainy z pytan derzhavnoi mytnoi spravy za 2016 rik

[Report on the results of the audit of the effectiveness of the execution of

powers by the territorial bodies of the State Fiscal Service for compliance by

business entities that carry out foreign economic activity with the legislation

of Ukraine on state customs for 2016]. Available:

<http://www.ac-rada.gov.ua/doccatalog/document/16749201/Zvit_5-7.pdf?subportal=main>.

Access: 12 May 2020.

RUF, M.; WEICHENRIEDER, A. (2015) The Taxation

of Passive Foreign Investment: Lessons from German Experience. Canadian Journal of Economics. DOI:

https://doi.org/10.1111/j.1540-5982.2012.01737.x

SHALIMOVA, N. (2017) The Public Function of a

Statutory Audit. Innovation Economics and

Management, v. IV, n. 2, p. 63–72. Available:

<http://dspace.kntu.kr.ua/jspui/handle/123456789/7065>. Access: 22 April 2020.

SINENKO, O.; MAYBUROV, I. (2017) Comparative

Analysis of the Effectiveness of Special Economic Zones and Their Influence on

the Development of Territories. International

Journal of Economics and Financial Issues, v. 7, n. 1, p. 15-122.

Available:

<https://www.econjournals.com/index.php/ijefi/article/view/3374>. Access:

01 May 2020.

VAKULCHYK, O.; FESENKO, V.; KNYSHEK, O. (2017) ²nternal

control and audit of enterprises’ compliance with customs requirements while

conducting foreign economic activity. Baltic

Journal of Economic Studies, v. 3, n. 4, p. 18-23. DOI:

http://dx.doi.org/10.30525/2256-0742/2017-3-4-18-23.

VAKULJCHYK, O. M.; RJABYCH, O. V. (2015) The

transfer pricing control mechanism and reporting system implementation

challenges: Ukrainian experience. Customs,

v. 2, p. 10-16. Available:

<http://212.1.86.13/jspui/handle/123456789/2134>. Access: 12 April 2020.

WEST, C. (2017) Status Quo of International Tax

Reform in South Africa: Implementation of BEPS and CRS and the Influence on

Domestic Law Amendment. SSRNElectronic

Journal. DOI http://dx.doi.org/10.2139/ssrn.3009193 Available:

<https://ssrn.com/abstract=3009193>. Access: 24 April 2020.

ZADOROZHNYJ, Z.; KAFKA, S.; ORLOVA, V. (2018)

Bukhhalterskyi ta upravlinskyi oblik spilnoi diialnosti pidpryiemstv z

vykorystanniam osnovnykh zasobiv [Accounting and management accounting of joint

ventures using fixed assets]. Visnyk Ternopiljsjkogho

nacionaljnogho ekonomichnogho universytetu, v. 2, p. 84-93. Available: <http://nbuv.gov.ua/UJRN/Vtneu_2018_2_10>.

Access: 26 April 2020.

THE RESULTS OF IMPLEMENTATION OF EUROPEAN REQUIREMENTS

IN MANAGEMENT OF TRANSFER PRICING AUDIT (EXPERIENCE OF UKRAINE)

THE RESULTS OF IMPLEMENTATION OF EUROPEAN REQUIREMENTS

IN MANAGEMENT OF TRANSFER PRICING AUDIT (EXPERIENCE OF UKRAINE)